CryptoSpace

IRS Crypto tax AUDIT notice probes deep - Key Takeaways & next steps

CryptoSpace

Devaluation of the US Dollar Could Decimate Savers! Strategies to Hedge Risk

Devaluation of the US Dollar

What to expect in this article?

- What is devaluation of currency

- How devaluation of currency impacts us

- Strategies to hedge against the currency devaluation

There is an apparent disconnect between Wall Street and Mainstreet.

This divide has not been as apparent and blatant as it has during this COVID crisis.

As the number of unemployment claims are rising to levels never seen before, Wall Street is rallying at full swing.

In the middle of this disparity and economic unrest, some economists are warning us to brace yet another crisis called Devaluation of Currency.

What is devaluation of currency?

Devaluation of currency is essentially reducing the value of currency.

Devaluation of currency is essentially reducing the value of currency.

This can be done through:

- Printing more money: When supply increases, price falls. This simple economic principle applies to everything

- Policy makers decision: Policy makers may decide to ‘devalue’ the currency to keep the country’s exports competitive. The US is a heavy importer, so this strategy, if implemented, could hurt the US more than other countries

- Selling off reserves: A country could dispose its reserves that pegs the fiat and then set a new exchange rate for its own currency (the disposal of reserves to buy its own currency either by taking out of circulation or printing more)

Sometimes devaluation of currency is not voluntary.

Look at countries like Argentina, Venezuela, etc., their currency devalued by multiple folds because their economy was deemed to be unsustainable.

Why devalue the currency?

Countries devalue their currency primarily for following reasons:

-

Exports

Let’s say if I export Saffron from India at 2 bottles per $1. IF India devalues its currency by 50%, now I can get 4 Saffron bottles for $1.

This drop in currency value encourages exports.

Countries like China, India and others who rely on exports (of goods and services) can reap greater economic benefit by devaluing its currency.

-

Trade Buffer

When a country notices that its imports far outweigh the exports, it can use the currency devaluation as a buffer measure to balance the trade equation.

Generally speaking, a weak currency encourages people to buy more from the nation (win for exports) and discourages people buying from outside the nation (a loss for imports).

-

Debt

Let’s say you owe me Indian Rupees 75,000, at the time of this writing, that would be around US$1000. Let’s say, India devalues its currency to 50%.

This means, I can still pay you back your Rs. 75,000 with $500.

While this strategy might not be great to service ‘outside’ debts that are denominated in foreign currency, it is a strategy used to service obligations within the country.

Devaluation of the USD in the wake of Yuan devaluation

The US is the number one importer in the world. It ranks number two as an exporter.

In theory, devaluation of its currency may help increase its export footprint.

However, due to recent devaluation of Chinese Yuan, the devaluation of the US dollar could work against the US, in the short term.

For one, devaluation of the US will simply equalize the impact of Chinese devaluation.

Two, it will make the imports more expensive thus might encourage demand for home products thus reducing the reliance on Chinese imports in the first place.

In addition, as things become more expensive in dollar denomination consumer demand could see a sharp decline which will further slow down the economic recovery.

Why should I be worried about devaluation?

Anyone holding their savings in the US dollars might have to pay attention to the possibility of devaluation of the US dollar.

Anyone holding their savings in the US dollars might have to pay attention to the possibility of devaluation of the US dollar.

If the US declares that it is devaluing its currency by 30% then your savings lose 30% value overnight.

In reality, the fear might set into the market and crash the valuation even further.

For example, if you were planning to retire with your $100,000 savings and the government devalues the currency by 30%, all of a sudden your $100,000 will only buy you goods and services worth $70,000.

That is a huge blow for people who have meticulously planned the mileage of their savings.

Can the US devalue its currency?

In theory, yes.

The United States has adopted a Strong Dollar policy for over 3 decades now and this gives it the status of global reserve.

If President Trump were to shock the markets to make a mark in global trade, he could order to devalue the US dollar.

If we know anything about Trump, he is all about shocking the world. So the realms of possibility of devaluing the US dollar are not out of the question.

Strategies to hedge against devaluation of currency

Lot of financial gurus and speculators are expecting the US government to use devaluation as a strategy to make good on its debt.

If this were to happen, you don’t want all of your life savings held up in the US dollar which could see a drop in its purchasing power.

Following assets have come to act as ‘hedge’ against any potential volatility in the US dollar value.

Real Estate

While the market is currently hyped up in real estate, it still could offer a safe haven in the event of devaluation of USD.

While the market is currently hyped up in real estate, it still could offer a safe haven in the event of devaluation of USD.

For instance, if you bought a property for $200,000 today with a fixed interest rate, in the event the US dollar is devalued to say 30%, then someone coming into the market will have to pay $260,000.

And because you have picked up the property for fixed interest, in theory, you could be paying lower interest compared to the rental costs in the post devaluation world.

This strategy may not work if the US undergoes a long recession as a result of devaluation and then falls into deflation (which will reverse the above strategy).

Bitcoin

Many financial veterans are turning to Bitcoin because of its deflationary supply and potential to change the financial markets forever.

Many financial veterans are turning to Bitcoin because of its deflationary supply and potential to change the financial markets forever.

Obviously, being a relatively new asset class, it is not a guaranteed safe-haven. Although many believe Bitcoin to be Gold 2.0.

A small stake in Bitcoin could turn into ZERO or a 10x of investment. No one knows which side the tide will turn.

Economic models based on demand and supply (and stock to flow ratio) suggest that Bitcoin has only one way to go: UP.

Bitcoin has a history of proving economic models wrong and shocking the world. Will it go upward into millions or crash and burn into oblivion?

Only time will tell.

Gold & Metals

While Bitcoin is considered money of the people and Gold has been regarded as the god’s money by Robert Kiyosaki.

While Bitcoin is considered money of the people and Gold has been regarded as the god’s money by Robert Kiyosaki.

Silver is considered an underdog at this point.

Between gold & silver, the metal duo has been long acting as a safe-haven for market volatilities.

Obviously, you cannot compare Gold and Silver trajectory to that of stock markets or bitcoin since these metals are designed to act as ‘hedge’ not as wealth multipliers.

Stocks

If looked at the stock market from a macro level, it has been on an upward trajectory, generally speaking.

If looked at the stock market from a macro level, it has been on an upward trajectory, generally speaking.

Even with the occasional recessions and rare depressions, Stock market has in general kept an upward trend from a macro perspective.

Within the stock market, there are some up and coming industries where the returns could be extraordinarily high, like for example:

Blockchain industry: Companies involved with blockchain space could see a great momentum in the coming decade.

Cannabis industry: Cannabis industry is slowly spreading its claws and becoming

mainstream in the similar fashion how Liqor once did.

5G: Beyond the conspiracies surrounding 5G, we know that this is the next phase of the

internet evolution and

BioTech: Whether it is advancing surgeries, or reversing age with stemcell inventions or

simply decoding the DNA to make medicine more personal, BioTech is a place where the next level of innovation will take place.

Artificial Intelligence: We are clubbing Augmented Reality, Artificial Intelligence into one basket and I think this space could hand out handsome returns.

Just because we do not invest in stocks doesn’t mean they are not a viable investment vehicle. DYOR and see if you can find some gems.

Few things to remember

Do not over-correct

You do not want to find yourself in a situation where you invest 100% into any one type of asset and that asset tanks in value.

For instance, if you invest 100% of your fiat into Bitcoin, what happens if Bitcoin crashes?

If you invest 100% in real estate, what if we face deflation instead of inflation and the price tanks or paying mortgages becomes too expensive?

You will then be forced to service a loan that might be higher than the rent you receive.

Point is, you want to hedge into different asset classes so that you are not putting all of your life savings in one type.

Safety net

Whether we face extreme inflation or deflation, we all need cash on hand to meet our daily needs.

You cannot easily sell your gold or real estate if you need cash flow. Bitcoin’s volatility makes it a bad choice to be looking to liquidate in the time of emergency.

You always want to keep a certain amount of money in liquid fiat to meet your immediate needs while you secure your financial future with an appropriate hedging model.

In conclusion

The topic of devaluation of currency is one that we all need to be at least aware of.

Having an hedging plan to withstand any surprises introduced by market volatility is important so that you are not wiped away, financially speaking.

The above hedging tactics are based on what we are looking to do personally. We cannot tell you what to do.

Thank you for reading and sharing this article. We appreciate you.

Get ‘Week in Crypto’ news updates in ONE email.

We never spam your inbox and we only send one email per week

with updates, news, eBooks, tax updates, and more!

Get knowledge, not spam! Subscribe here.

IMPORTANT DISCLAIMER

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

We do not endorse or guarantee the accuracy of the information and claims made.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

CryptoSpace

Is Elrond better than Ethereum? Should I invest?

Elrond(ERD) Token Review

Would the modern magic of internet work if we were still using dial ups? If you are from the generation that doesn’t know what a dial up means, it looks like this:

AOL Dial Up Internet Connection Sound + You’ve Got Mail (America Online) 90’s

Take a walk down memory lane and listen to the AOL (America Online) Dial-up internet connection sound and the famous You’ve Got Mail. Subscribe to Adventures…

Essentially, it would take you 30 seconds to 3 minutes to connect to the internet and open a text email.

If you were to load the YouTube website at the 56kbps speeds (considered good in those early internet days), it would take you probably 20 minutes.

We tried to load YouTube at 56 kbps speeds and after 7 minutes we were still waiting for the page to load. Compare that to the broadband that loads YouTube in a split second.

You can test what it feels to browse at 56kbps here.

While it is quite an extreme and dramatic example, I think that is the closest you can come when you try to explain what Elrond is in comparison to Ethereum.

At its current state, Ethereum processes 15 transactions. Compare that to Elrond which processed 35000 transactions during the test net run.

Obviously, the test environment is different compared to the real world.

Ethereum 2.0 could solve some of Ethereum 1.0’s flaws with claims of 100,000 to Million TPS. That is something we have to wait and see.

OK, what is Elrond?

There have been at least 100 Ethereum killers on the market since the birth of Ethereum. Ethereum (Classic) couldn’t kill Ethereum, so we are not sure others will.

Ethereum currently has serious scalability and TPS issues. Listen to this clip where Vitalik admits that Ethereum 1.0 cannot scale.

No Title

ICO prospectus: “Build scalable apps on Ethereum.” Mod: “Youre saying the concept of launching something that doesn’t scale then rebuilding it as something thats scalable was part of initial the plan.”Lubin: “We knew it wasn’t going to be scalable for sure.”Vitalik: *nods* pic.twitter.com/MBSFkQeugj

Ethereum 2.0 could be a whole another story. However, it is not a reality at the time of this writing.

Elrond on the other hand already delivers on what Ethereum 2.0 is ‘aiming’ to.

In a somewhat hyped elevator pitch, Beniamin Mincu, CEO of Elrond, said that Elrond is a 1000x improvement over other protocols in the blockchain space.

In a nutshell, Elrond offers a high throughput blockchain ecosystem that makes use of sharding that ‘scales’ (adapts) with the demand put on the network.

This adaptive sharding helps Elrond to be efficient, secure, scalable and provide a high rate of TPS.

This is why Elrond boasts itself as “A highly scalable, fast, and secure blockchain platform built for internet scale.”

What makes Elrond Special?

The strength of Elrond, in our opinion, is not in its novel or groundbreaking innovation.

It is in the simplicity of picking the ‘best’ of all the blockchain protocols that preceded and only solve the issues that these protocols failed to solve.

For instance, Elrond picks sharding from Zilliqa but makes it ‘adaptive’. It picks interoperability from Cosmos and implements it at Virtual Machine level.

Elrond says it as much in its whitepaper: “Elrond was designed upon and inspired by the ideas from Ethereum, Omniledger, Zilliqa, Algorand and ChainSpace.”

If we are to compare blockchain revolution to the internet, we have to assume that many companies will be replaced by newer solutions.

Whether Elrond is that ‘next generation’ blockchain or if it will be eaten away by another project is something we have to wait and see.

For now, let’s focus on what Elrond promises that makes it special.

“1000x improvement” over its predecessors

“Elrond is a new blockchain architecture that can bring 1000x cumulative improvement in scalability, throughput, transaction speed and transaction cost,” that is how Beniamin Mincu, CEO of Elrond, explains the project.

Scaling

Elrond promises to be able to ‘adapt’ to the scaling needs of the network. The project uses what is called ‘adaptive sharding’.

For the technically inclined, here an excerpt from the whitepaper:

“Elrond proposes a dynamically adaptive sharding mechanism that enables shard computation and reorganizing based on necessity and the number of active network nodes. The reassignment of nodes in the shards at the beginning of each epoch is progressive and nondeterministic, inducing no temporary liveness penalties.”

Sharding is the process of breaking down a big problem into small ones to solve it faster.

Security

Elrond uses a modified version of Algorand’s Secured Proof of Stake concept.

Secure Proof of Stake randomizes the ‘selection of a node’ so that security is not compromised through 51% brute force.

Elrond goes one step further on this sPoS model where it introduces ‘stake and rating’ criteria to be even eligible to be randomly picked as a node.

Adaptive sharding is the ability to scale up or down the number of shards depending on the transaction at hand.

Obviously, that is a dumbed down English explanation of it, as we understood it.

This makes selection of nodes ‘random’ while taking meritocracy into consideration.

The rating is dynamic and is recalculated at the end of each execution.

ERD Token

Many investors in the crypto space don’t care what the project does if the tokenomics are weak.

-

Transaction fees

Elrond’s utility is acting as the ‘native’ token on the network to pay for the transactions. The more transactions that take place on the network the more Elrond will gain in demand.

-

Staking

Elrond offers crazy returns on staking. This means, there is a probability that many tokens will be locked out of circulation which could boast the price.

-

DApp Deployment

Like any other blockchain network, Elrond token acts as the ‘utility’ on the DApps deployed on the network.

-

Validator reward

Validators are rewarded for their work and Elrond token is used in disbursing these rewards.

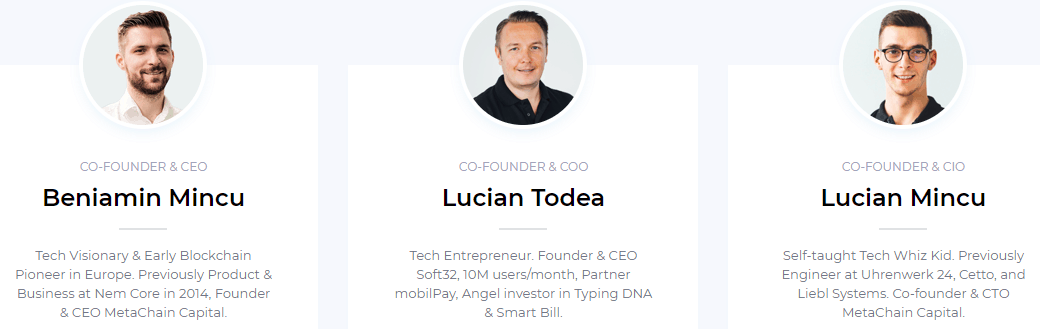

Team

Crypto space is excited about the team that is involved in the Elrond project.

Just looking at the profiles of CEO, COO and CIO showcases that you are not dealing with a group of wannabes.

The team brings in the right mix of technical prowess and business acumen.

Many blockchain projects either lack a strong technical forte or suck at running the business. Elrond may not have that problem due its ‘experience mix’.

Partnerships and Integrations

This is one project that is making a lot of buzz in the past two months, with continuous updates and partnerships. Here are a few:

ERD and Indacoin

Indacoin is a fiat gateway with over 500K users which allows users to buy crypto with Visa or Mastercard using USD, GBP, EUR and many other currencies.

ERD and dfinance

Elrond will work together with dfinance to enable users to build Elrond native assets as well as allow Elrond users to access DeFi platforms on dfinance.

ERD and LDV

ERD tokens are now available on LDV, a Romanian crypto exchange and a fiat gateway. ERD/EURO and RON/ERD pairs will be available on the platform.

ERD and Crypto.com

Users of Crypto.com can now buy ERD token on their app. Crypto.com is considered one of the easiest modes of buying and selling crypto. With deposits and withdrawals of erd token enabled on crypto.com, the token is now available for over 3 million users of crypto.com

ERD and Utrust

Elrond integrated with one of the leading payment gateway for ecommerce, Utrust.

ERD and Swipe

ERD is partnered and now available on swipe, a multi currency digital wallet. Swipe has over 500K users.

The other partnerships and integrations include Stateless Money, Staked, Moonpay, FinNexus, and many others.

Elrond is gaining traction fast and furious. Will it amass enough steam to surpass other blockchain protocols?

We have to let the time answer that question.

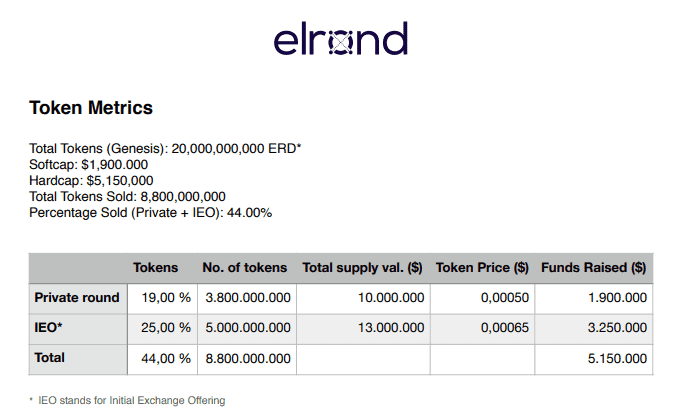

ERD Token Metrics

Source: Elrond

*These token metrics are about to change after the EGLD swap.

Some pump and dump chat

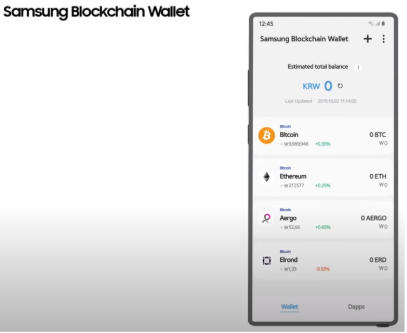

You will notice that Elrond is showcased on the Samsung official video introducing Samsung Blockchain.

First and foremost thing everyone is excited about is its mainnet launch.

We believe the rise in price is not just because of its mainnet launch, but also the high staking rewards that are expected to yield after the mainnet launch.

With over 5 Billion ERD tokens already staked during the testnet, it is possible that more users will stake their tokens for passive income.

Risk factors

Late to the party, not to the town!

There are a lot of blockchain platforms in the blockchain space. Many promise sun and the moon with 100K to a million transactions per second.

Most of these promises are just that as of now, promises.

Elrond is late to this TPS race, however, it could do what others have failed: Actually live up to its claims on the Main net.

In this sense, Elrond is late to the TPS party but it is not late to ‘make a mark’ for itself in the blockchain town.

More advanced projects in the space

What happens when Ethereum addresses its TPS issues, scalability aspects and makes it incredibly easy for people to launch DApps?

Ethereum already has a massive penetration in the space that it could leverage.

Beyond Ethereum, there are other projects like Zilliqa that could pose stiff competition to projects like Elrond.

And, do not forget Cardano, a project that is preparing its arsenal for a hostile takeover of the crypto space.

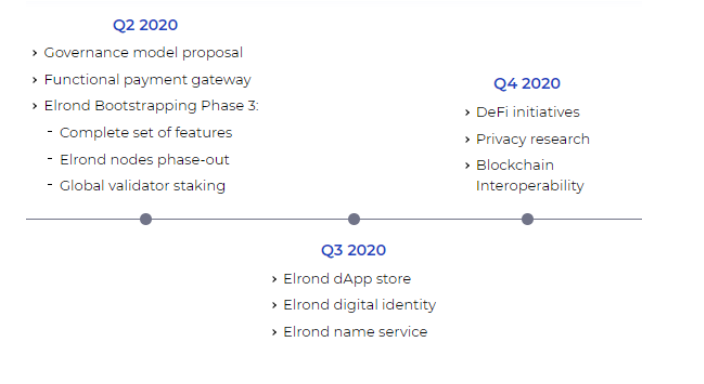

What is a head in Elrond’s Roadmap

Source: Elrond

Elrond Swap

ERD to eGLD

How to swap ERD

Pros of Elrond Token Swap

Cons of Elrond Token Swap

Get ‘Week in Crypto’ news updates in ONE email.

We never spam your inbox and we only send one email per week

with updates, news, eBooks, tax updates, and more!

Get knowledge, not spam! Subscribe here.

IMPORTANT DISCLAIMER

Everything in this article is an opinion, not an advice of any kind. This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Please consult with a professional for specific advice.

We do not endorse or guarantee the accuracy of the information and claims made.

All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

CryptoSpace

V-ID is bringing real world use case to Blockchain, can it succeed?

-

CryptoSpace2 years ago

CryptoSpace2 years agoComparing the BEST Cryptocurrency tax software [Updated for 2020]

-

CryptoSpace2 years ago

CryptoSpace2 years agoWill Security Token Offerings (STO) take over crypto market in 2019?

-

Crypto News2 years ago

Crypto News2 years agoBull Stampede ahead!

-

CryptoSpace2 years ago

CryptoSpace2 years agoAre you a UNITED STATES resident with Binance or KuCoin accounts? Your funds may get FROZEN if you fail this important reporting obligation

-

CryptoSpace2 years ago

CryptoSpace2 years ago82% of the Fortune 100 have explored Blockchain, here are the details!

-

CryptoSpace2 years ago

CryptoSpace2 years agoProjects to pay attention to before they breakout (including new recommendation)

-

CryptoSpace2 years ago

CryptoSpace2 years agoCryptos and Movies, an uncanny comparison

-

CryptoSpace2 years ago

CryptoSpace2 years ago“Crypto Investors Need Better Tax and Accounting Tools”, says CEO of ZenLedger